With the addition of digital channels to the already diverse range of sales and distribution touchpoints, the consumer product industry now carries one of the most complex networks of information exchange today. But as a rising number of stakeholders are getting involved in fulfilling customer preferences, the challenge of distribution efficiency is cropping up in debates. Many brands see digitization and data-driven decision-making as the answer. To this end, they are investing, sometimes heavily, in digital tools, for their distributors to use. They believe that as these tools proliferate and get embedded into operational workflows, they will get the data they need from the field as well as the ability to drive agility, flexibility, and resilience down the channel.

But things don’t quite work out that way in most cases. The biggest problem? The distributors use the tools too little, too badly, or not at all. Let’s examine why, and what’s the downstream impact of this reluctance?

The case for digital technology

From field agents to regional or local distribution companies, retail brands constantly face the need to tap into insights from all who are involved in the fulfilment operations. It is only when every link of the distribution network contributes data to the brand will it be able to have end-to-end visibility into its business’s performance.

One of the key solutions that the retail industry looks toward to solving their siloed stakeholder information exchange problem is by investing in smart technologies. In fact, the global market for smart retail is expected to be worth over USD 785 billion by 2027, according to studies. By leveraging a diverse pool of digital platforms and process re-engineering initiatives, retailers expect their most complex challenges in multi-channel sales operations to be addressed. But even then, there is a key roadblock that stands in its way. There is a growing concern among retailers regarding the adverse behaviour of distributors who simply ignore the need to use tools and platforms supplied by retail brands to help in end-to-end management of the retail cycle.

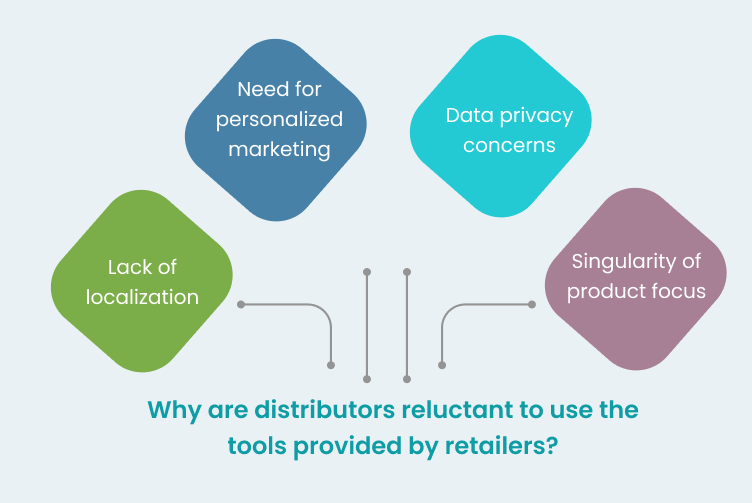

Why are distributors reluctant to use the tools provided by retailers?

It is crucial for retailers to clearly understand the core reasons behind the low adoption of their digital mechanisms by distributors’. Only then would they be able to make necessary amendments and foster universal integration of their digital channels. That will be necessary to empower end-to-end fluidity and visibility into their fulfilment ecosystem. Let us explore the top concerns that distributors have in leveraging the distribution platforms offered by retail brands:

Lack of localization

Distributors or distributor companies better understand regional or geographic preferences in areas where they do business. It may not be the case with the retail brand to whom they have signed up for product distribution. In such a scenario, distributors will find it hard to incorporate localized flavours in their operations if they rely solely on the brand’s digital solutions.

A key example would be language localization. Field service agents who operate in a particular region may be engaging with customers or retail outlets where the local language has greater utility. If the platform used by the distributor doesn’t support the language preferences of end-users, then it will result in severe overhead for field executives or even regional distributor office staff.

Need for personalized marketing

Similar to the scenario of localized appeal, distributors may have better ideas to market a product in a regional or target market. They will have a better understanding of the channels where their end users consume marketing content, the preferences in outreach programs with respect to content themes, time of approach, medium of approach, etc. When a retail brand tries to offer distributors “top-down” digital solutions that help them in their marketing efforts, the solution may not have the ability to offer personalized marketing support for distributors. When it does have the capability, it may be hard to learn, use, and maintain. This makes the distributor reluctant to turn to the tools for crucial operations because sup-optimal marketing and promotion could impact their sales pipeline. In effect, they may end up using the tools to the minimum extent as mandated by the brand and most of the “real” activities will be conducted outside the boundaries of the tool.

Singularity of product focus

When a retail brand offers digital solutions to distributors, the solution will usually be customized and configured to support and serve the needs of products sold by the brand alone. However, from a distributor’s perspective, they may have partnered with different retail brands. They are often involved in the distribution and fulfilment of multiple competing products simultaneously. Hence, having a single product or brand restricted digital solution to manage their operations will not be the desired approach for distributors. That’s not scalable and too much of a time and effort investment on the part of the distributor.

Data privacy concerns

A distributor may not prefer their entire business operational data to be available for access by retail brands as it may lead to privacy and data integrity concerns over time as well as the fear of micromanagement from the brand. They will require necessary levels of abstraction across their information gateways to protect their own business interests as well as honour their commitments to multiple retail brands that have partnered with them for distribution.

While digital solutions can help bring transparency and efficiency to the entire retail landscape, retailers need to address the core issues that often prevent the channel from adopting their tools. Distributors would prefer the digital infrastructure they deal with to be flexible and accommodative of localized features as well as honour privacy concerns. Hence, while selecting a distribution solution to help streamline channel sales operations, retailers need to keep the distributor in mind. Get in touch with us to know how that can be achieved.