To improve their market reach, more B2B companies and companies dealing with consumer products are plugging into their distributor management tools (be it in-house or hosted on the cloud). What’s more, sales teams are leveraging the capabilities of Sales Force Automation (SFA) solutions to automate processes like placing an order, tracking deliveries, and monitoring their product stocks for their field sales representatives and distributors.

Recent statistics reveal that almost two-thirds of a field sales rep’s time is spent in executing non-revenue generating activities. Through automation, SFA solutions can eliminate this time spent by field sales executives and improve their productivity.

Having said that, how do these brands handle the various SFA challenges including collecting the right data from their distributor network? Let us look at a few of these challenges and how to handle them.

Sales Force Automation – 5 key challenges

While it is easy and beneficial for product companies to implement an effective SFA solution for their team of product distributors, it also comes with its share of challenges that can result in implementation failure.

Here are 5 key challenges that companies must address when selling consumer products through their distributor channels:

User resistance

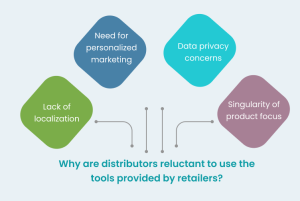

How effective is your SFA solution if it is not optimally used by end-users (or your distributor’s field sales team)? Not much. Why is that? For a start, SFA makes the entire sales process more transparent, with more monitoring of daily field activities. Most sales teams do not appreciate the notion of ‘being watched.’ Furthermore, end-users are resistant to changing their ‘established’ workflows. The problem is further exacerbated with distributor reluctance to use multiple interfaces and reporting templates foisted on them by the multiple brands they carry.

To address this challenge, product companies must focus on amply training their distributor workforce right from the start of their association. This provides them sufficient time to understand the benefits and be informed of the workflow changes. They should get a sense of how the tool will help them sell better and sell more.

Unstructured data

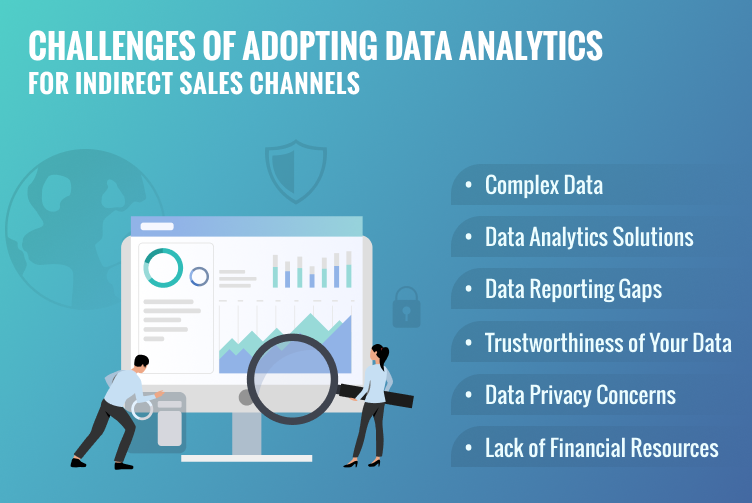

Every SFA solution is driven by accurate data. To extract the right insights, companies need access to high-quality data extracted from their sales processes, distributor networks, and retail outlets. Unstructured data from diverse sources needs to be gathered and cleaned for generating accurate analytics.

Besides user resistance, distributors are hesitant to share field sales data due to concerns about data privacy and security because of their wide product portfolios. The key to the effective use of sales data is to divide and categorize the data in a structured format before deploying it in the SFA solution.

Lack of customization

Customization is essential for product companies working with an extensive distribution network that spans multiple countries or regions. To be effective, local distributor sales teams need a customized SFA platform that can satisfy their market needs and customer requirements. Sales teams and channel managers need customization to unify their operational view across geographical regions and markets.

Further, an efficient SFA solution needs to be fully integrated with the distributor’s existing systems including ERP and legacy systems, to leverage the maximum insights from the generated field sales data.

Poor implementation

Product companies without business vision or long-term objectives have limited success when implementing SFA for their distributor network. Effective SFA implementation requires long-term planning and effort to ‘onboard’ the entire distributor network before going ahead with it.

The key to proper SFA implementation is to determine the entire process and from where to kickstart the transformation. Additionally, product companies must design a proper schedule of execution from the start till completion, along with challenges and opportunities at every stage. For example, building company branded mobile-based SFA apps that support field sales reps to submit their orders and add their daily collections.

Post-implementation challenges

The challenges of a Sales Force Automation solution are not limited to its planning and implementation but go beyond that. How well are distributors responding to the new system? And what about user resistance? Post-implementation monitoring is essential to ensure that both product companies and end-users are adapting efficiently to the technology.

Post-implementation measures include monitoring of changes due to any solution enhancement or any system upgrades. Additionally, it includes proper training of “slow learners or adapters” after observation. Other encouraging measures include incentive management for sales distributors at every country level or the use of the gamification-based system for sales personnel.

How do product companies overcome challenges in SFA associated with data collection? Let us explore the solution next.

Data collection challenge in SFA and how to overcome it

As we have seen from the previous section, efficient data collection and analysis are crucial for the successful implementation of a Sales Force Automation system. The challenge for product companies is to efficiently collect sales data from their network of distributors and integrate the cleaned data into their sales system.

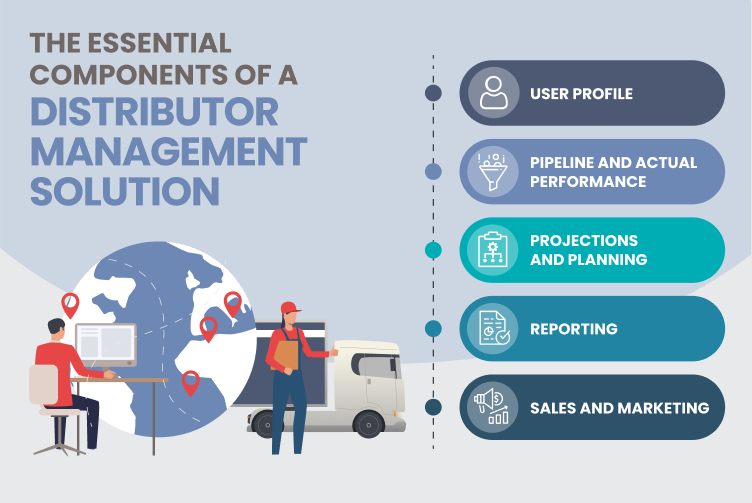

With more companies running business applications on the cloud, distributors and field sales staff can’t always be depended on to address laborious and time-consuming manual data entry and collection. Product companies need a productive distributor solution that automates the data collection process using a “services” component where the data collection, collation, uploading, and cleaning is a key part of the solution itself.

End-users including sales distributors do not collect and upload data for a variety of reasons including:

- Inaccuracy is caused due to improper selection of data sources in a particular consumer market or geographical region.

- Incompleteness is caused when the sales data records are incomplete and not fit for generating accurate insights.

- Redundancy is caused due to the collection of outdated sales data that are no longer useful to the company.

Here is how a service-supported distributor management system can overcome data collection issues using its services component:

- Enables aggregation of relevant data (taken from a wide range of sources) into a data lake containing small sets of sales data.

- Addresses data security concerns by protecting all third-party data (for example, customer records, purchased products) and only providing relevant insights to the brand.

- Facilitates distributor convenience to upload their sales data using a single tool.

Conclusion

In a growing distributor-led market, brands need to deploy the right Sales Force Automation solution to capture accurate sales data across international borders. Having said that, implementing a successful SFA solution has its share of hurdles.

With its one-stop iSteer distribution solution, Amshuhu has been a technology partner that has enabled its customers to automate their data collection and analysis process to amplify the power of the Sales Force Automation. This has in turn helped in improving their distributor sales and in reducing manual labour.