Consumer product companies and B2B product companies alike employ distribution networks to meet their needs to achieve market reach and sales dominance. The challenge, however, is how this relationship functions once it has been established.

In an ideal world, the distributor is an extension of the business and can be managed in a manner similar to one’s own enterprise. This translates to the companies and distributors working in tandem to ensure sales plans and marketing strategies stay on track. However, since this is an area prone to cut-throat competition, and every distributor and every market is different, there are always issues with alignment.

These can be in the form of operational challenges, conflicts, value issues, and/or reporting discrepancies, among others. For instance:

- Cross-Sales: Concerns might surface when hesitancy to pitch complementary products seeps in, or the distributors are, in some way or the other, obligated to cater to competing product lines. The latter can escalate the conflict of interests, leading to significant deviations from the established plan of action.

- Poor Performance:Lack of data integration, unification, and feedback can lead to under or over-delivery and poor service. This might cause the client to lose trust in the distributors, alienate their customers and suppliers, and discourage them from trying out other opportunities.

- Price Discrepancies:Distributors might need to sell at a higher price to improve their profitability or appeal to customers in certain regions where supply is lower or distribute at a lower price for the sake of brand equity or convenience. This entails that both the company and distributor need to strike a deal that works for both sides across every touchpoint.

- Knowledge Gap:Distributors may lack the information they require to function optimally. Often, the distributor may not be aware of the issues at hand and how they affect the overall performance.

- Quality Concerns:The inadequacy of supply, inadequate quality control, or fraud can lead to losses in potential revenue and a massive dent in reputation, brand value, and goodwill.

It is essential to ensure that problems do not arise when managing a distribution channel because once they do, they can trigger a cascade of repercussions leading to the eventual failure of the company’s business plan. As is often the case, many of these problems get magnified and their impact seems outsized when it comes to small companies as against the larger players.

In that light, it would be prudent to step back and examine the way distribution challenges work for all companies, especially smaller companies.

Aggregating Insights Through Integrated Distributor Systems

Distributions involve a lot of high-level decisions, ranging from the strategic bindings to the nitty-gritty details of operations. Difficulties can arise with one or more of these decisions. For example, a company may need to sell products through a distributor in one territory but in another such action may not be in the enterprise’s best interest due to cost implications, logistics issues, and competitive concerns. The onus is on the decision-makers to make the right calls.

Such a scenario can be derailed by a lack of information leading to poor decision making, which may eventually lead to costly mistakes. In such instances, a networked enterprise system that connects all relevant systems and data points can help mitigate risk and facilitate better decision-making.

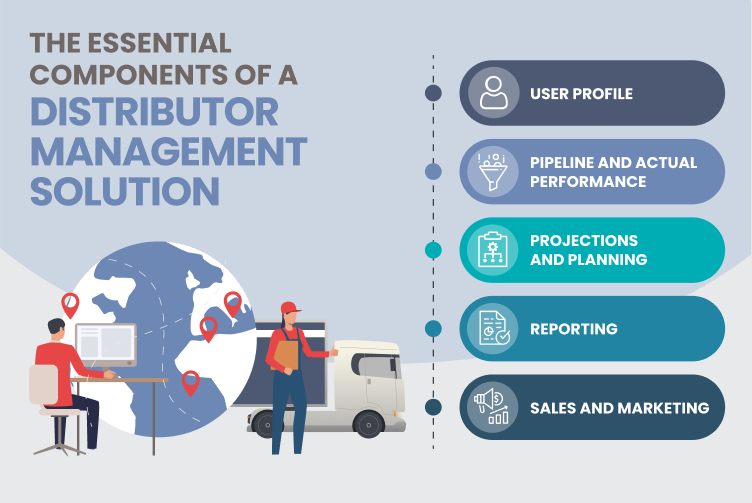

At the heart of this system lies a distributor-focused module that aggregates all distributor-related data from disparate enterprise systems. This module must work in an automated fashion to pull in critical metrics and details across the relevant enterprise systems and consolidate them into a dataset that gives business users a unified view of the current situations.

Keeping Track of KPIs – Distribution Performance Reports

Proper oversight of distributor activities through careful monitoring of regular KPIs helps small businesses assess their performance and always keep their eyes on the ball. Likewise, having a running total of distributor quantity and quality, supply chain volumes, and distribution costs can help even the smallest companies determine the best distribution strategy that matches the needs of their go-to-market strategies.

This is made possible by complementing the aforementioned data integrated system with a unified view that is consistent across mobile apps (for field users), web dashboards (for managers and distributors), and spreadsheet templates (for financial and operational specialists). This can help the top executives better handle the situation by pushing down unnecessary details and allowing them to focus on what’s more important.

For example:

- The geo-tagging facility can be embedded in the sales funnel system to let distributors know whether a particular order is coming from a specific location. Distribution managers can use this information to make informed decisions and allocate resources based on which region needs their attention the most.

- Supply chain metrics can be streamed in real-time to distributors and managers to give them a picture of the overall business and their role in it on an ongoing basis. This can help them respond to problems and proactively act in cases where bottlenecks are expected.

Taking Charge of the Distributor Marketplace

The size of the businesses and their strategic goals may vary, but the way they collaborate with and administer the distributors could very easily follow a similar mechanism with the right tools in place. For instance, a company might choose to keep its distribution consolidated and under the supervision of a single entity, while another might go with a more distributed model. But both the cases would entail distribution management matters being closely tied to the business model and governance of distribution.

There are, however, certain things that companies can do to make their distribution model more collaborative and efficient.

- Visualizing the data patterns and maintaining analytics-driven oversight to keep a close eye on the ground, monitor shifts in demand, and identify promising new opportunities.

- Ensuring that their distribution channels have the best possible intelligence. This involves ensuring that distributors have access to the best quality products, keeping them abreast of changes in operations, and ensuring that they are well aware of everything that is happening in their respective territories.

All in all, by leveraging the capabilities of a robust and easy-to-use enterprise-wide system, distributors and small companies alike can do their part towards ensuring that products flow smoothly from vendors to end-users and that the channel continues to evolve and be maintained as an essential part of the organizational framework. Talk to us to know the dimensions of such a system.